BTC Price Prediction: Technical Breakout and Fundamental Catalysts Point Toward $120,000+ Targets

#BTC

- Technical Strength: Price holding above 20-day MA with improving momentum indicators suggests underlying bullish sentiment

- Regulatory Tailwinds: SEC's accelerated ETP approval process and expanding institutional access create favorable conditions

- Macro Catalysts: Currency instability and gold market share comparisons provide fundamental support for higher valuations

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Consolidation Above Key Moving Average

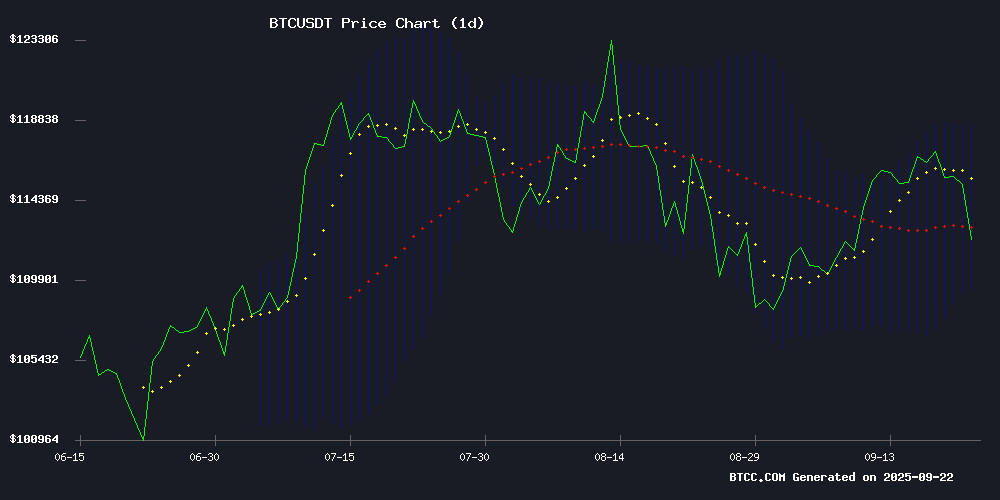

BTC is currently trading at $114,423.77, slightly above its 20-day moving average of $114,066.29, indicating underlying strength in the current price level. The MACD reading of -3,229.39 remains in negative territory but shows improving momentum with the histogram at -786.07. Bollinger Bands position the price between $118,612.85 (upper) and $109,519.72 (lower), suggesting a consolidation phase with potential breakout opportunities.

According to BTCC financial analyst Michael, 'The technical setup suggests BTC is building a solid foundation above the 20-day MA. A sustained break above $118,600 could trigger the next leg higher toward $120,000 resistance.'

Market Sentiment: Bullish Catalysts Align for Bitcoin's Next Rally

Current news FLOW presents a predominantly bullish backdrop for Bitcoin. Multiple catalysts including Coinbase's expansion into financial super app territory, SEC's accelerated approval process for digital asset ETPs, and ongoing macroeconomic uncertainties surrounding traditional fiat currencies are creating favorable conditions.

BTCC financial analyst Michael notes, 'The convergence of regulatory progress, institutional adoption, and macroeconomic instability provides strong fundamental support. The $350,000 price target based on Gold market share perspective appears increasingly plausible given current developments.'

Factors Influencing BTC's Price

Bitcoin's Path to $350,000: A Gold Market Share Perspective

Bitcoin could surge to $350,000 if it captures 30% of gold's market capitalization, according to a recent analysis. Gold's $24 trillion market cap dwarfs Bitcoin's $2.4 trillion valuation, highlighting the potential upside for the cryptocurrency.

Historical parallels suggest Bitcoin often rallies after gold hits record highs. Analysts argue that even a conservative revaluation to 30% of gold's market share would justify a $350,000 BTC price. The digital asset's superior properties as a store of value could accelerate this transition.

Coinbase Aims to Evolve into a Financial 'Super App' Beyond Crypto Trading

Brian Armstrong, CEO of Coinbase, outlined ambitious plans to transform the platform into a comprehensive financial services hub during an interview with Fox Business. The exchange seeks to integrate traditional banking features with crypto-native solutions, positioning itself as a potential bank replacement.

Armstrong highlighted recent product launches like the Bitcoin rewards credit card as early steps toward this vision. The 4% crypto-back offering directly challenges traditional card networks' fee structures, demonstrating Coinbase's disruptive approach to payments infrastructure.

Political tailwinds appear favorable, with Armstrong noting unprecedented bipartisan momentum for crypto legislation in Congress. Regulatory clarity could accelerate Coinbase's expansion into savings, investing, and payment services - all built on blockchain rails rather than legacy financial systems.

Vietnam's Bank Account Purge Highlights Bitcoin's Value Proposition

Vietnam's financial system has undergone a seismic shift with the abrupt closure of 86 million bank accounts—nearly 43% of the country's estimated 200 million accounts. The State Bank of Vietnam's sweeping biometric mandate, requiring facial scans for account access and transactions, has left foreign residents particularly vulnerable due to stringent in-person verification requirements.

This unprecedented financial exclusion event serves as a case study in centralized system fragility. Bitcoin's permissionless nature and censorship-resistant design stand in stark contrast to Vietnam's account freezes, which were ostensibly implemented to combat fraud and money laundering. The purge underscores cryptocurrency's core value proposition: sovereign individual control over assets.

Market observers note such government actions historically correlate with increased Bitcoin adoption. The Vietnamese scenario mirrors past capital controls in China and Cyprus, events that previously catalyzed local cryptocurrency demand. While no direct exchange volume spikes have been reported yet, the structural parallels bear monitoring.

Can Bitcoin Price Break $120,000? Depends On These Factors

Bitcoin's price hovered near $115,717, showing minor fluctuations as market participants eyed key resistance levels. Analysts observed a recurring pattern of rejection, retest, and rise—a rhythm that previously preceded upward breakthroughs at $30,000, $48,000, and $93,000.

The cryptocurrency's ability to hold above the mid-$115,000 zone could signal another leg higher, while failure might shift focus to lower supports. Trading volume and trend structure remain critical for confirming buyer conviction.

Washington's bipartisan digital-asset bill discussions added macroeconomic context, though price action continued to follow technical frameworks. Traders treat these patterns as probabilistic roadmaps rather than guarantees.

SEC Approves Fast-Track for Digital Asset ETPs Amid Commissioner Dissent

The U.S. Securities and Exchange Commission has enacted a pivotal rule change, enabling exchanges to streamline the approval process for certain exchange-traded products—including those holding digital assets. This decision bypasses the traditional, case-by-case SEC review that has long stifled the industry's growth.

Commissioner Caroline Crenshaw issued a scathing dissent, accusing the agency of neglecting investor protections by accelerating "nascent and unproven" products. Her objections underscore the regulatory tension between innovation and risk mitigation.

The move marks a watershed moment for digital assets, which have faced protracted battles for mainstream acceptance. Spot Bitcoin ETF applications languished for nearly a decade before securing approval, while other crypto products endured repeated delays. Now, the floodgates may open.

Gold and Bitcoin: Divergent Paths in an Era of Monetary Expansion

Gold has surged 38% year-to-date in 2025, outperforming Bitcoin's 23% gain during the same period. Yet the longer-term narrative reveals a stark contrast: Bitcoin has consistently reached new all-time highs against the U.S. M2 money supply with each market cycle, while gold remains below its 1980 inflation-adjusted peak.

The divergence underscores their distinct roles in modern portfolios. Gold maintains its centuries-old reputation as a stability anchor, presently trading at levels comparable to 1975 when adjusted for money supply growth. Bitcoin, by contrast, demonstrates how digital scarcity interacts with monetary expansion—hitting fresh highs against M2 during last month's rally.

This monetary framing reveals what price charts alone obscure: gold preserves wealth across generations, while Bitcoin captures the velocity of financial innovation. Both assets tell complementary stories about value preservation—one measured in millennia, the other in market cycles.

Argentine Peso Crisis Tests Milei's Libertarian Reforms as Bitcoin Advocates Watch

Argentina's central bank has deployed nearly $1 billion in reserves to stabilize the peso, marking its largest currency intervention since 2019. The currency's collapse to 1,510 per dollar—down from 900 on the black market when President Javier Milei took office—undermines his libertarian pledge to end monetary instability through radical economic liberalization.

Bitcoin proponents who initially celebrated Milei's anti-central bank rhetoric now witness the unraveling of his monetary experiment. Saifedean Ammous, author of The Bitcoin Standard, notes the peso's precipitous decline continues despite government interventions, declaring: "The ponzi is coming to an end." The crisis reinforces Bitcoin's narrative as a hedge against failing fiat regimes.

Bitcoin's Role in a Potential Dollar Collapse: Chaos Over Liberation

The rapid decline of the U.S. dollar has sparked renewed discussions about 'hyperbitcoinization' among Bitcoin enthusiasts. However, Fernando Nikolic, former VP at Blockstream and a witness to Argentina's financial crises, warns that a collapsing dollar doesn’t inherently translate to Bitcoin's triumph. 'Bitcoiners celebrating dollar collapse don’t understand what they’re asking for… It’s not liberation, it’s your grandmother eating cat food because her savings evaporated,' he cautions.

Historical currency collapses suggest that in times of genuine economic breakdown, basic necessities like ammunition—not digital assets—become the primary stores of value. Many proponents of a sudden shift to a Bitcoin-based economy lack firsthand experience of societal disintegration. Nikolic emphasizes that the reality would be far more chaotic than idealized scenarios.

The U.S. fiat system shows signs of strain, with median home prices reaching record highs in 2025. The price-to-income ratio has never been higher, rendering homeownership increasingly unattainable. This economic pressure underscores broader systemic vulnerabilities, though Bitcoin's role in such a crisis remains speculative at best.

Analysts Predict Strong October Bitcoin Rally Amid Historical Trends

Bitcoin is poised for a potential double-digit rally in October, building on historical trends where positive September performances have consistently led to significant gains the following month. In September 2024, BTC rose 7.29%, followed by a 10.76% surge in October. The pattern repeated in 2023 with a 3.91% September gain preceding a 28.52% October jump.

Market psychology is reinforcing the "Uptober" effect as traders and investors position for the anticipated rally. Institutional and retail demand continues to climb, creating a self-fulfilling prophecy of upward momentum.

The April 2024 halving event—which slashed mining rewards by 50%—has exacerbated Bitcoin's supply shock. Historical halving cycles suggest prolonged bullish phases; the 2016 halving preceded BTC's meteoric rise to $20,000 in 2017, while the 2020 halving ignited another historic bull run.

TradFi's Influence on Bitcoin Volatility: A New Era of Market Maturity?

Bitcoin's price action near $115,700 has sparked a debate on whether traditional finance (TradFi) is stabilizing or reshaping its notorious volatility. Michael Saylor, in a recent Coin Stories podcast interview, argued that reduced volatility is a sign of maturation, attracting mega institutions. "You want the volatility to decrease so the mega institutions feel comfortable entering the space and size," he said, framing it as a natural evolution.

CME Group reported a record $7.1 billion in crypto options notional open interest on September 9, driven by Bitcoin contracts. This surge highlights institutional players' growing reliance on derivatives for risk management. While TradFi may not eliminate Bitcoin's volatility entirely, it could smooth out extreme swings, leaving room for mean-reverting trends and occasional shocks.

The focus now shifts to whether ETF inflows will sustain their positive momentum, further cementing Bitcoin's place in mainstream finance.

Asian Crypto Landscape This Week: Regulatory Shifts and Market Debuts

Vietnam has taken a decisive step into the cryptocurrency arena with the approval of its first regulated exchange under Resolution 05/2025. The framework mandates stringent capital requirements and institutional ownership ratios, signaling a structured approach to digital asset adoption. Upbit is poised to lead this initiative, marking a significant milestone for Vietnam's blockchain ecosystem.

Across Asia, regulatory momentum is accelerating. Japan continues to facilitate expansion while India focuses on audit mechanisms. The region is rapidly emerging as a hub for institutional crypto activity, with banks and fintech firms increasingly exploring tokenization.

How High Will BTC Price Go?

Based on current technical indicators and fundamental catalysts, BTC appears poised for a move toward $120,000 in the near term. The combination of strong technical support above the 20-day moving average, improving MACD momentum, and overwhelmingly positive news sentiment creates favorable conditions for upward movement.

| Target Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $120,000 | High | 1-2 months | Technical breakout, institutional inflows |

| $150,000 | Medium | 3-6 months | ETF approvals, macroeconomic trends |

| $200,000+ | Moderate | 6-12 months | Adoption acceleration, regulatory clarity |

Michael from BTCC emphasizes that 'while short-term volatility remains, the structural bull case for Bitcoin continues to strengthen with each regulatory development and institutional adoption milestone.'